Understanding GST Advance Ruling: A Practical Guide for Tax Planning and Compliance

The Goods and Services Tax (GST) has simplified India’s indirect tax system, but it also brings new questions for businesses. Many taxpayers often wonder how GST applies to specific transactions, goods, or services. This is where the GST Advance Ruling mechanism becomes an invaluable tool.

At Social Justice Lions, we believe that understanding how to use Advance Rulings can help businesses stay compliant, reduce tax risks, and plan more effectively. This article explains what GST Advance Ruling means, why it matters, and how businesses can use it for better tax planning and compliance.

Understanding GST Advance Ruling: A Practical Guide for Tax Planning and Compliance: Social Justice Lions

What is an Advance Ruling under GST?

An Advance Ruling is a written decision given by tax authorities to an applicant on questions related to GST law. It helps a taxpayer know how the tax will apply to a particular situation before undertaking the transaction.

For example, a company planning to import goods can apply for an Advance Ruling to know the GST rate or whether Input Tax Credit (ITC) applies. This clarity helps prevent future disputes with tax authorities and ensures smoother operations. Essentially, the Advance Ruling acts as a preventive legal tool for taxpayers.

Why GST Advance Ruling is Important

The GST law can be complex due to the wide range of products, services, and state-specific variations. A single misinterpretation can lead to penalties or litigation.

An Advance Ruling gives taxpayers confidence that their tax treatment is correct. It reduces ambiguity and ensures compliance with the law.

At Social Justice Lions, we encourage businesses to seek Advance Rulings proactively — not only when problems arise, but also during major business decisions such as mergers, imports, or inter-state supplies.

Legal Framework Governing Advance Rulings

The Advance Ruling mechanism is governed by Chapter XVII of the Central Goods and Services Tax (CGST) Act, 2017. It covers Sections 95 to 106, supported by Rules 103 to 107A of the CGST Rules, 2017.

Under this framework, each state has a State Authority for Advance Ruling (AAR) and an Appellate Authority for Advance Ruling (AAAR).

These authorities have the power to clarify issues such as:

- Classification of goods and services

- Applicability of GST rates

- Determination of liability to pay tax

- Eligibility for Input Tax Credit

- Requirement for registration

- Time and value of supply

Thus, taxpayers can rely on a legally recognized process to clarify any tax uncertainty before making key financial decisions.

Who Can Apply for an Advance Ruling?

Any registered taxpayer or even a person intending to register under GST can apply for an Advance Ruling. This includes:

- Individuals or sole proprietors

- Companies and partnerships

- Non-profit organizations (NGOs)

- NRIs conducting business in India

- Joint ventures or consortiums

At Social Justice Lions, we help applicants draft well-prepared submissions that cover all necessary details, ensuring faster and more favorable rulings.

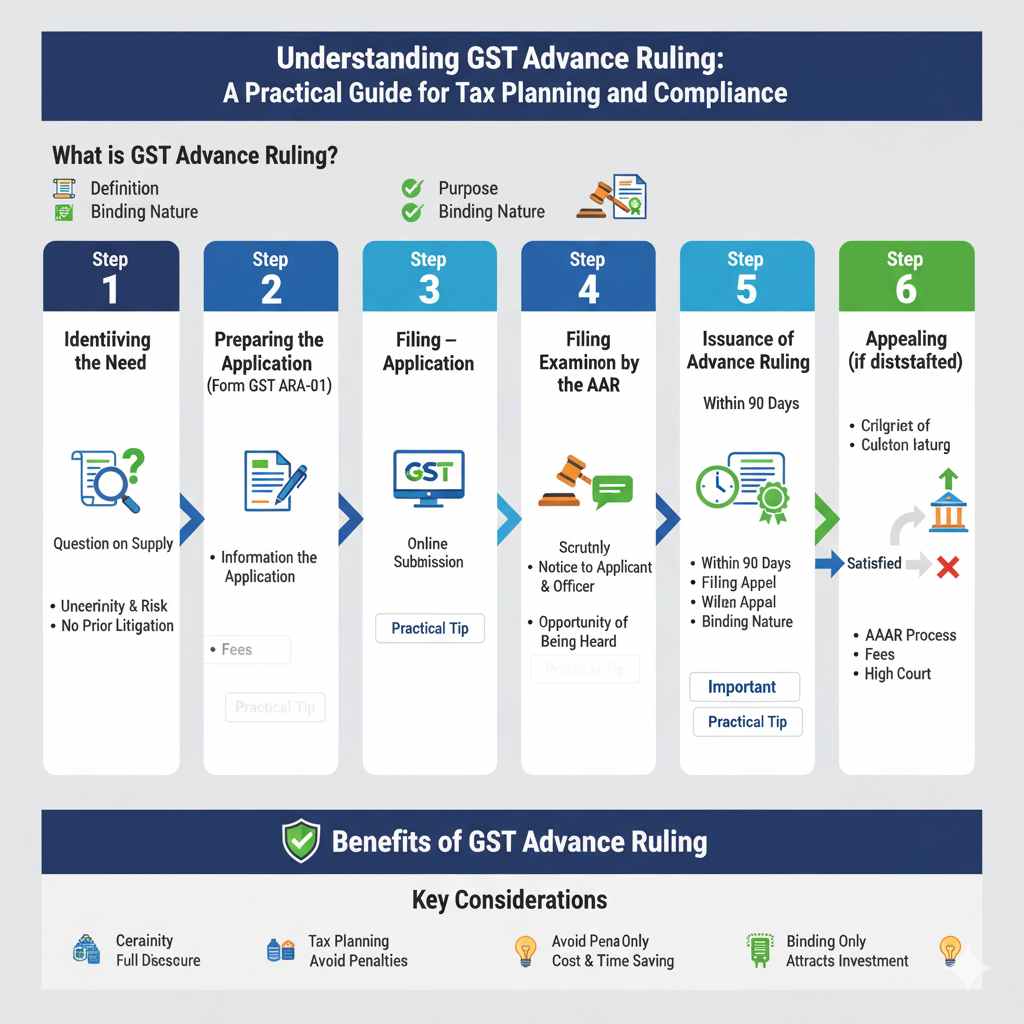

How to Apply for a GST Advance Ruling

The process of applying for an Advance Ruling involves a few structured steps:

- Filing the Application:

The applicant files Form GST ARA-01 with a prescribed fee of ₹5,000. The application should clearly state the question for which the ruling is sought. - Review by the Authority:

The Authority for Advance Ruling examines the application, may request additional documents, and conducts a personal hearing. - Issuance of Ruling:

The AAR issues a written decision within 90 days of receiving the application. - Appeal Process:

If either party disagrees with the ruling, they can appeal to the Appellate Authority for Advance Ruling (AAAR) within 30 days using Form GST ARA-02.

Our legal team at Social Justice Lions ensures that all steps are completed accurately and on time to avoid rejection or delay.

Key Benefits of Advance Ruling for Tax Planning

Using Advance Ruling as part of your tax strategy brings several benefits:

- Certainty and Clarity:

It helps businesses understand how GST applies to their specific transactions. - Avoidance of Litigation:

Advance Ruling decisions reduce future disputes with tax officers, saving both time and money. - Better Financial Planning:

Businesses can plan prices, contracts, and budgets accurately since tax implications are known in advance. - Compliance Confidence:

It demonstrates a proactive approach to compliance, improving the taxpayer’s credibility with authorities. - Decision Support:

When entering into new markets or introducing new products, Advance Rulings guide strategic tax planning.

At Social Justice Lions, we integrate these benefits into your overall compliance framework, ensuring your tax strategy remains strong and legally sound.

Challenges in the Advance Ruling Mechanism

While the Advance Ruling process offers many advantages, it also has certain challenges:

- Inconsistent Rulings Across States:

Different states may interpret GST provisions differently, leading to conflicting decisions. - Limited Scope for Questions:

Only specific matters are allowed under the law, leaving out broader tax issues. - Delay in Ruling:

Authorities may take longer than expected to issue rulings due to high caseloads. - Binding Nature:

The ruling binds only the applicant and the jurisdictional officer, not all taxpayers.

Despite these limitations, our firm helps clients interpret rulings strategically and align their business operations accordingly.

Appeals and Revisions under Advance Ruling

If a taxpayer disagrees with the decision of the AAR, they can appeal to the AAAR. If the issue remains unresolved even after the appellate order, the matter can be taken to the High Court through a writ petition.

At Social Justice Lions, our litigation experts assist clients in preparing strong appeals, supported by case law, statutory interpretation, and practical reasoning.

We also track rulings from different states to identify trends and precedents that strengthen your case during appeals.

Impact on Business Operations

Advance Rulings not only help in tax compliance but also influence broader business decisions. They guide pricing strategies, supply chain planning, and contract drafting.

For instance, if an Advance Ruling classifies your product under a higher GST rate, you can adjust your pricing model accordingly. Similarly, if a ruling clarifies eligibility for Input Tax Credit, you can restructure vendor agreements to optimize costs. At Social Justice Lions, we align your legal and business objectives, helping you make well-informed decisions with full awareness of tax implications.

Role of Legal Experts in Advance Ruling

Applying for an Advance Ruling involves legal precision. The application must be drafted carefully with supporting documents and legal reasoning. Any mistake can lead to rejection or an unfavorable outcome.

Our firm provides expert assistance in:

- Drafting and filing Advance Ruling applications

- Representing clients before AAR and AAAR

- Interpreting existing rulings for legal clarity

- Handling appeals and revisions

- Advising on tax risk management

By engaging our services, clients gain confidence in their compliance and enjoy peace of mind knowing that professionals are handling their GST matters.

Case Example: How Advance Ruling Helped a Business

One of our clients, a logistics company, was uncertain about whether GST applied to inter-state transport services between branches. Our team prepared a detailed application, highlighting relevant legal provisions and precedents.

The AAR ruled in the client’s favor, confirming that the transaction was not taxable. This ruling saved the company from unnecessary tax liability and future disputes.

Such success stories highlight the practical benefits of proactive tax consultation and the value of expert legal guidance.

How Social Justice Lions Supports You

At Social Justice Lions, we believe tax compliance should not be a burden. Our team of experienced tax lawyers and consultants simplifies complex GST procedures and helps businesses make informed choices.

We offer:

- Personalized consultations for tax planning

- Assistance in filing Advance Ruling applications

- Legal representation before tax authorities

- Compliance reviews and GST audits

- Continuous advisory support for evolving tax laws

Our approach combines legal expertise, practical insights, and proactive communication, ensuring clients stay ahead in compliance and strategy.

Frequently Asked Questions

A GST Advance Ruling is a written clarification given by tax authorities on specific questions about GST law. It helps taxpayers understand how GST applies to their transactions before they act. This ensures clarity, prevents disputes, and promotes compliance. Social Justice Lions advises clients to seek rulings early for smoother tax planning.

Any registered taxpayer or person intending to register under GST can apply. This includes individuals, companies, partnerships, NGOs, and NRIs doing business in India. Our firm assists applicants in preparing clear and legally sound applications that improve the chances of a favorable ruling.

Applicants can seek clarity on GST rate classification, applicability of exemptions, input tax credit eligibility, time of supply, and registration requirements. Social Justice Lions helps clients frame questions precisely so that authorities provide meaningful answers.

An Advance Ruling is binding only on the applicant and the jurisdictional tax officer. However, it serves as a strong reference for similar transactions and helps in shaping future tax decisions. We also help clients interpret rulings strategically to guide compliance across operations.

We handle the entire process — from drafting applications and attending hearings to filing appeals if needed. Our team ensures accuracy, compliance, and timely action so clients gain legal certainty and avoid unnecessary tax disputes.

Conclusion

The GST Advance Ruling system is more than just a legal mechanism — it is a practical tool for certainty, planning, and trust. Businesses that use it wisely can avoid disputes, enhance transparency, and strengthen their compliance reputation. With expert guidance from Social Justice Lions, you can turn GST complexities into opportunities for smarter tax management.

Read More

- Advocating for Medical Malpractice Matters: We’re Here for You

- SVB Investigations under Indian Customs: Compliance Strategies for Importers and Related Parties

- Advocates for Your Rights: Solicitors at Your Service

- Guidance in Real Estate Law: Building Your Future Together

- Product Liability Matters: Trust Our Expertise

- GST Council — Advance Rulings